BSP Hosts BSP Pay Demo Session for SMEs

In continuing the awareness on the ‘BSP Pay’ platform, BSP Financial Group Limited (BSP) staged a demonstration session for its SME customers at the BSP Waigani Head Office on Thursday 17th June, 2021, with the aim of providing information on the benefits of the platform and how to register and use BSP Pay.

BSP Pay is a “No Card, Just Pay” payment solution that allows a BSP Account Holder to carry out Online Payments on registered BSP Merchants online shop instantly and securely without the use of card details. The only information required is the Customer Information File (CIF) Number (BSP ID) and a registered mobile number.

The event saw close to 25 SMEs in attendance and the BSP Team were present to assist with information and registration of the various Digital Banking platforms.

Present at the event was BSP SME customer and owner of Tapioca Delight Ginia Sialis, who shared her experience as a BSP Pay Merchant saying, “Convenience for our customers is definitely something we strive to provide. We are excited about BSP Pay and it is a game-changer in managing cash flow, paying suppliers faster and enhances business growth. Thank you for making the digital experience fast, safe and modern.”

Tapioka Delight SME preparing for the session

Tapioka Delight SME preparing for the session

BSP Group Retail General Manager Daniel Faunt when addressing the event said, “due to COVID-19, many businesses, especially SMEs are slowing down, stepping back and re-shaping their business model. BSP is taking this time to empower our SME’s through this event to adopt digital strategies to help accelerate your resilience and competitive advantage in the local and also global marketplace.”

“BSP Digital banking is more than just taking your business online. It is the idea that fully expands business and increase customer base not only locally but also globally via the BSP Internet Payment Gateway (IPG),” said Faunt.

“BSP digital products and services provide solutions for businesses in expanding reach and adopt the Niupela Pasin Act. As a leading digital bank, BSP does not come with a one-size fits all approach. We are creatively designing solutions that meet the demographics, connectivity bandwidth and cost effective needs in all regions BSP operates in, which is every province in PNG and within the Pacific, “added Faunt.

“It’s pleasing to know that some of our SME customers tonight are using not just one payment solution but more than one to provide convenience to your own customers,” concluded Faunt.

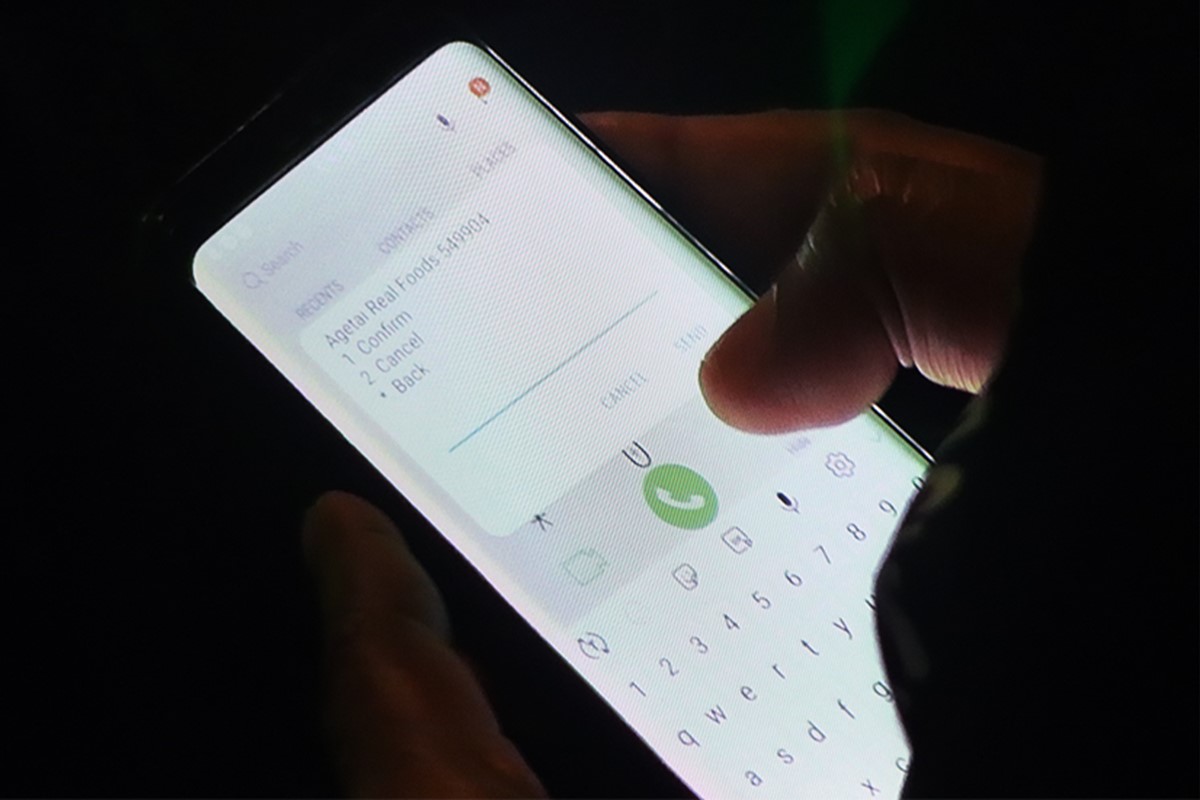

Speaking at event as well was another successful BSP SME customer - Margaret Luku, Director and owner of Agetai Real Foods who also shared her recent experience as a BSP Mobile Banking Merchant. “The BSP Team helped me register as a Mobile Banking Merchant. I experienced first-hand recently when my EFTPoS device was down a few weeks ago and I didn’t have enough of the right notes for change, customers using Mobile Banking to make payments into my SME account made it very easy and it was less hassle handling cash for change.”

BSP Staff purchasing food packs from Margaret Luku, Director and owner of Agetai Real Foods

BSP Staff purchasing food packs from Margaret Luku, Director and owner of Agetai Real Foods

“My advice to my SME friends is to have a few payment options suitable for your business as this will provide convenience, less hassle and you can concentrate more on running other areas of your business and our customers will also have options they can use to pay as well,” added Mrs Luku.