BSP: “Additional Company Tax” will deter further Foreign Direct Investment

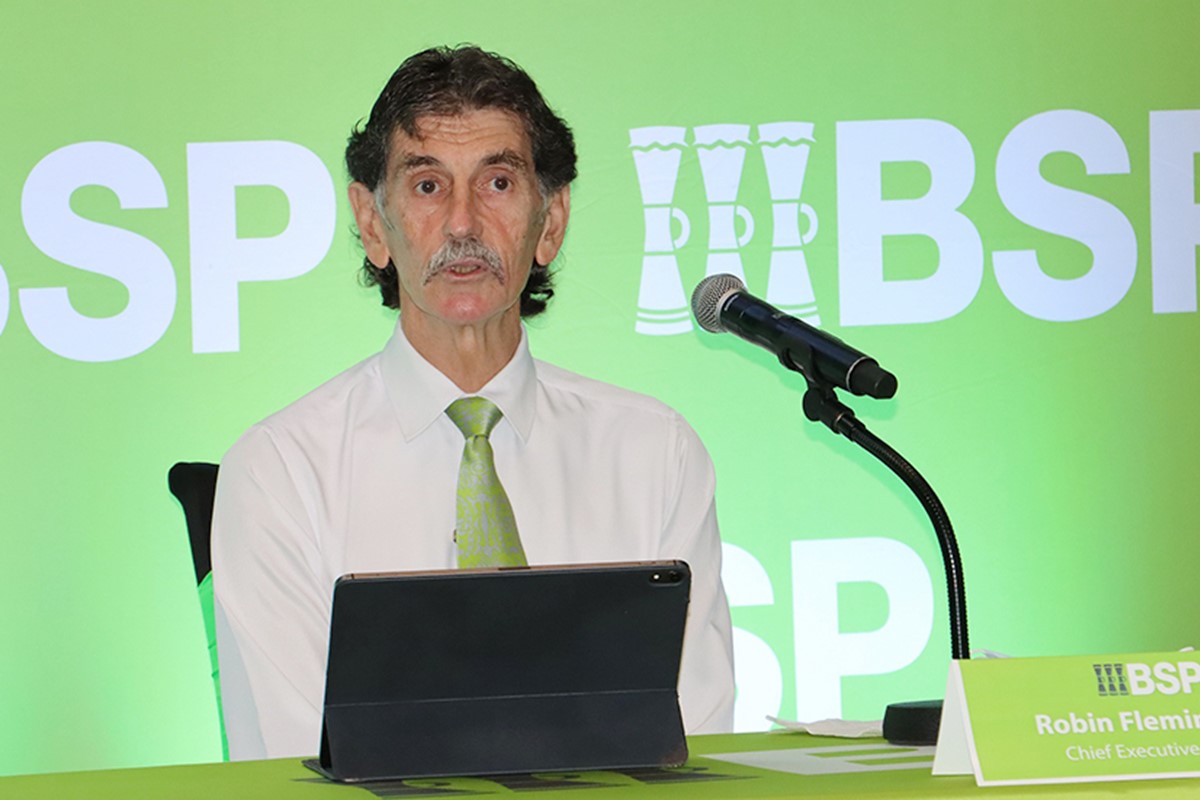

The new Additional Company Tax introduced following the March 2022 sitting of Parliament, will ultimately increase uncertainty and reduce investor confidence in PNG, says BSP Group CEO Robin Fleming.

“Consequently, the Tax may well result in a further reduction in Foreign Direct Investment (FDI) at a time when PNG needs increased FDI,” Mr. Fleming said.

According to the BSP Pacific Economic and Market Insight Q1 2022 Report, Mr. Fleming said clearly the new tax will have a direct negative impact on BSP shareholders with the tax taken up in BSP’s first quarter results for 2022.

The Report stated that BSP is also hearing concerns from the broader corporate sector about the seemingly arbitrary nature of the tax.

“This has resulted in a high degree of business uncertainty that may well reduce their appetite to make decisions on investments and capital expenditure as the tax sends a message to businesses not to invest and strive to be successful,” Mr. Fleming said.

Mr. Fleming stated in the report that the new tax will also reduce the attractiveness of PNG’s banking industry, making it less likely that offshore banks will enter the PNG market. This will further reduce competition at a time when ANZ recently exited PNG’s retail market, with the sale of its retail businesses to Kina Bank.

“The recent amendments to the Income Tax (Amendment) Act 2022 introduced significant change, with the Additional Companies Tax, based on a company’s market concertation and the one-time tax liability on Digicel of K350 million, appear arbitrary and will adversely impact future business investment decisions, Mr. Fleming added.

“When confidence is up, customers are buying, sales are higher, jobs are created, inventory investments are made, capital expenditure increases, and business owners feel assurance that the future for their business looks bright, which then boosts economic growth,” said Mr. Fleming.